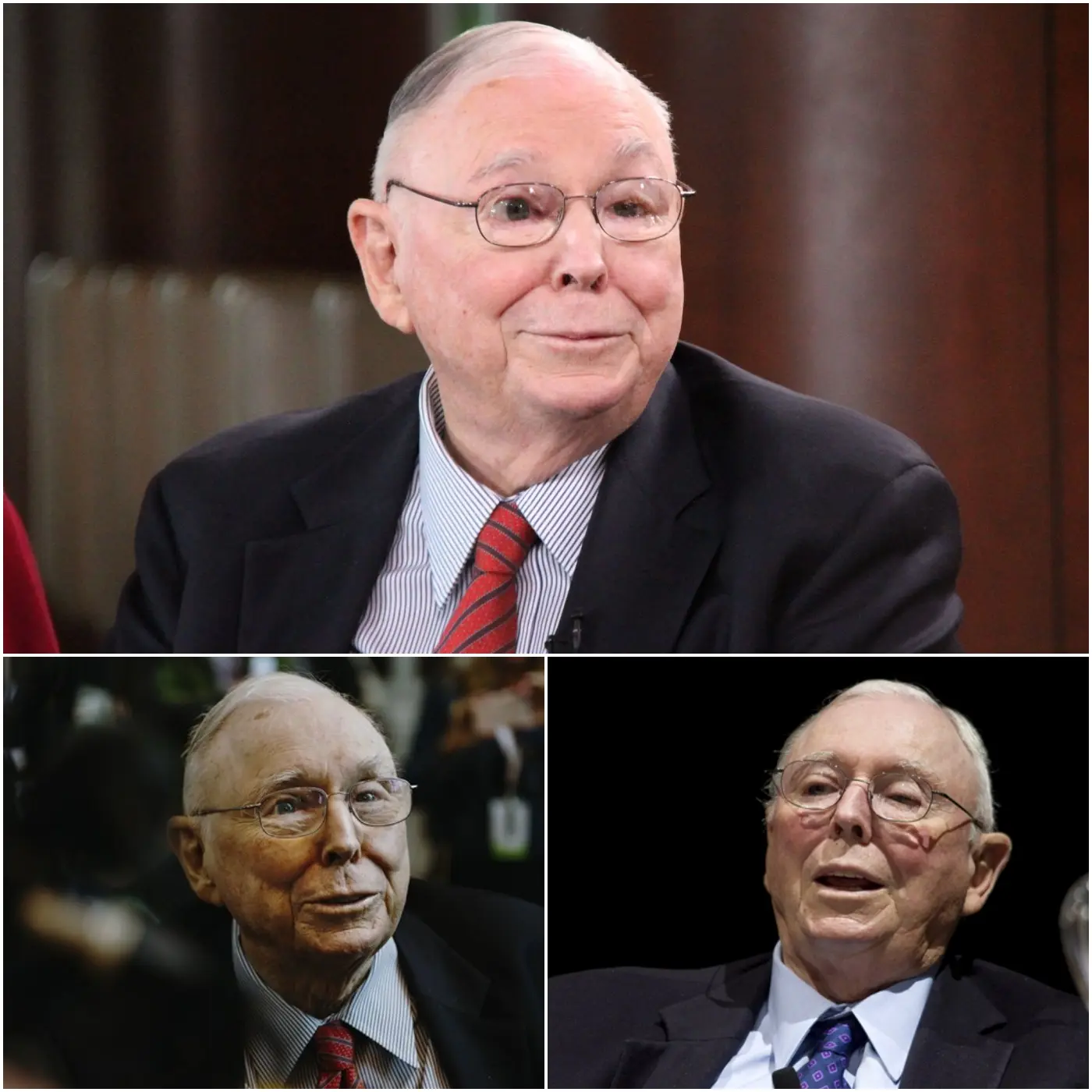

In one of his last public appearances before his passing, billionaire investor Charlie Munger left the world with an extraordinary financial insight. During the 2023 Daily Journal shareholder meeting, Munger revealed that he had stopped carrying fire insurance after becoming wealthy, opting instead to self-insure.

This revelation shocked many, not because of its simplicity, but because it came from the vice chairman of Berkshire Hathaway — a conglomerate known for its massive investments in the insurance industry. Munger’s choice raised a profound question: how much protection do the rich really need?

Munger calmly explained, “Once I got rich, I stopped carrying fire insurance on houses. I just self-insure.” His reasoning was rooted in rationality, not rebellion. To him, wealth should change the way people think about risk, not amplify their fears.

His statement was not a criticism of the insurance industry, but a reflection of his philosophy on intelligent risk management. Munger believed that when you have enough money to handle a loss yourself, it becomes unnecessary to pay others to do it for you.

“Why would you want to fool around with a claims process?” he added, highlighting his disdain for bureaucratic inefficiencies. For Munger, insurance was a tool meant for those who genuinely needed protection, not for those who could afford to absorb potential losses.

This perspective aligns with his broader life philosophy: simplicity, discipline, and rational decision-making. Munger often emphasized that successful people must learn to think independently and not blindly follow conventional rules, especially when those rules no longer serve them.

At Berkshire Hathaway, Munger and Warren Buffett built an empire partly on the power of insurance float — the cash held between collecting premiums and paying claims. Ironically, while he helped manage one of the largest insurance operations in history, Munger himself decided he no longer needed personal coverage.

To understand Munger’s mindset, one must first grasp his unwavering commitment to logical thinking. He spent decades teaching that good judgment often requires doing the opposite of what most people do, as long as the decision is backed by sound reasoning.

For an ordinary person, fire insurance provides essential security. Losing a home could mean financial ruin. But for Munger, whose wealth ran into billions, a fire would only be an inconvenience, not a catastrophe. His wealth acted as his own safety net.

Still, Munger was careful to note that this strategy was not universal. “This only works if you can afford to take the hit,” he implied. For the average homeowner, skipping insurance would be reckless and dangerous.

He viewed risk through a mathematical and psychological lens. Most people, he believed, misjudge probabilities and let fear dictate financial decisions. By contrast, Munger saw risk as something to be measured, not avoided.

His comments at the 2023 meeting offered more than financial advice — they were a reflection of his worldview. Munger’s approach to life was deeply Stoic: focus on what you can control, accept uncertainty, and never let fear make your choices for you.

In that sense, his decision to self-insure wasn’t about saving money but about mastering control. By removing unnecessary dependencies, he simplified his financial life and strengthened his confidence in his own judgment.

Observers also saw Munger’s stance as symbolic of his lifelong independence. He never cared about social norms or popular trends; his only concern was logical consistency. He often said that people should “invert, always invert” — meaning to think in reverse to find the best solutions.

Applying that logic, Munger realized that for someone wealthy, paying premiums year after year for unlikely events made no sense. The rational choice was to accept the small risk of loss and move on with life.

This mindset reveals why Munger was not only a brilliant investor but also a master thinker. His lessons extended beyond finance — they were about clarity, courage, and self-awareness in decision-making.

When asked whether such views might hurt Berkshire Hathaway’s reputation, Munger laughed off the idea. He understood that insurance remained vital for society, especially for those without financial buffers. His decision was personal, not ideological.

He believed that true wealth was not about money itself but about freedom from unnecessary worry. By self-insuring, he symbolically freed himself from a system designed to trade fear for profit.

Even in his later years, Munger’s clarity of thought inspired millions. He never shied away from uncomfortable truths, even when they contradicted his own business interests. That intellectual honesty was what set him apart from most billionaires.

For young investors and entrepreneurs, his message was clear: learn to think for yourself. Don’t just follow what everyone else is doing because “that’s how it’s done.” Real wisdom lies in understanding when conventional advice no longer applies to you.

Charlie Munger’s decision to self-insure may seem trivial, but it encapsulates a lifetime of disciplined reasoning. It wasn’t about arrogance — it was about mastery over fear, uncertainty, and dependence.

As he once famously said, “The big money is not in the buying or the selling, but in the waiting.” That same patience and rationality guided his view on insurance — understanding that not every risk needs to be outsourced.

In the end, Munger’s final lesson reminds us that wisdom is not about complexity, but clarity. He showed that true security doesn’t come from policies or paperwork, but from the calm confidence of a well-trained mind.

Even after his passing, his words echo a timeless truth: financial success is not just about building wealth, but about learning when — and why — you no longer need to buy protection from fear.